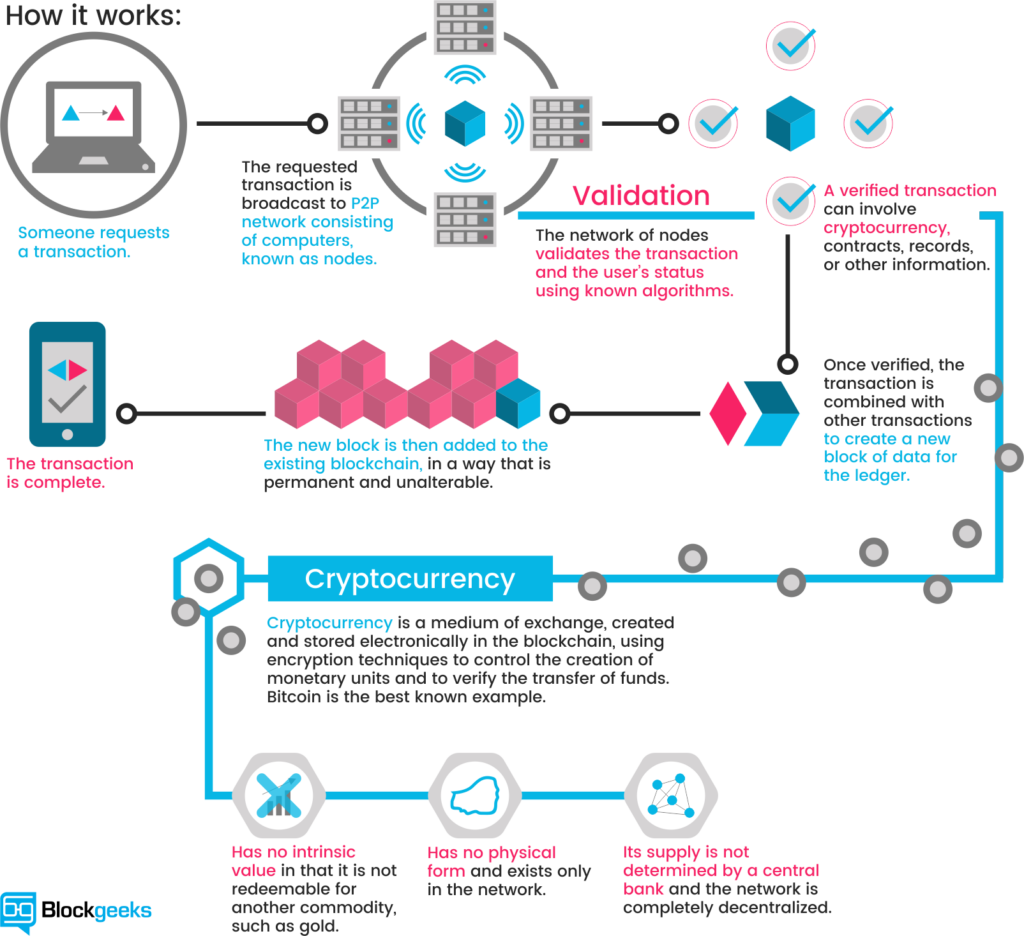

In a nutshell: it’s a public ledger that holds all the entries needed to keep the bitcoin accounting up to date. To put it easy: imagine a real-life ledger. It has pages and pages of listings: Tommy spent $ 2 in a coffee, Vicky sent Tommy $ 500 for a consulting job, Nathalie received $ 100 from George, etc. Every page in that real life ledger is a block in a blockchain: a block contains data; that is, entries in a ledger.

Apparently, is not that simple (there are metadata and other information) but for our purpose, that’s not important.

Pages in our blockchain are glued together by some metadata: a hash points to the prior block, just like the numbers printed in a real-life ledger assures anyone that no page is missing.

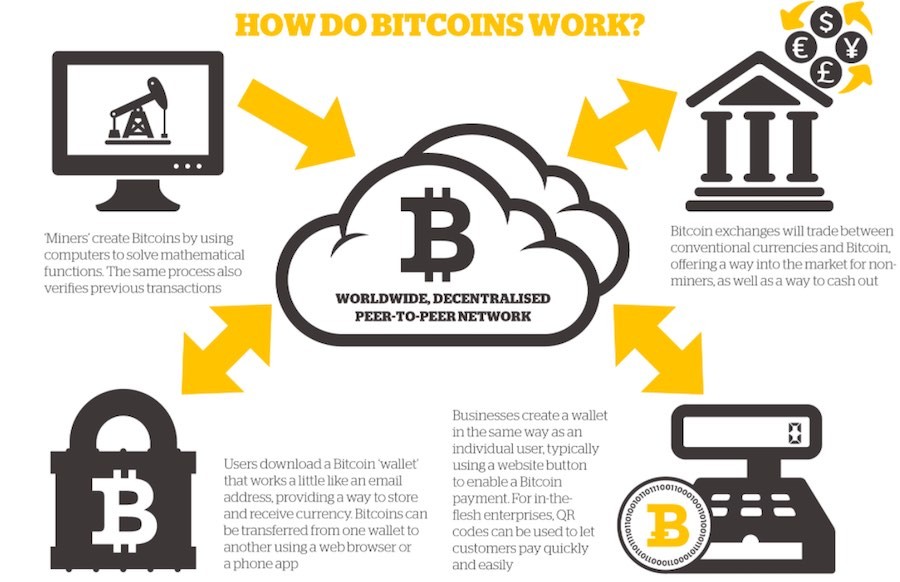

Also, every block in the blockchain is validated by all the computers involved, in a scenario known as reaching consensus. Every computer minting bitcoins is helping to create new blocks (pages in our ledger), and, thus, validating and securing all the entries on that block (or page). Securing the blockchain (and receiving bitcoins in exchange for the effort) is what is called mining.

Mining bitcoins

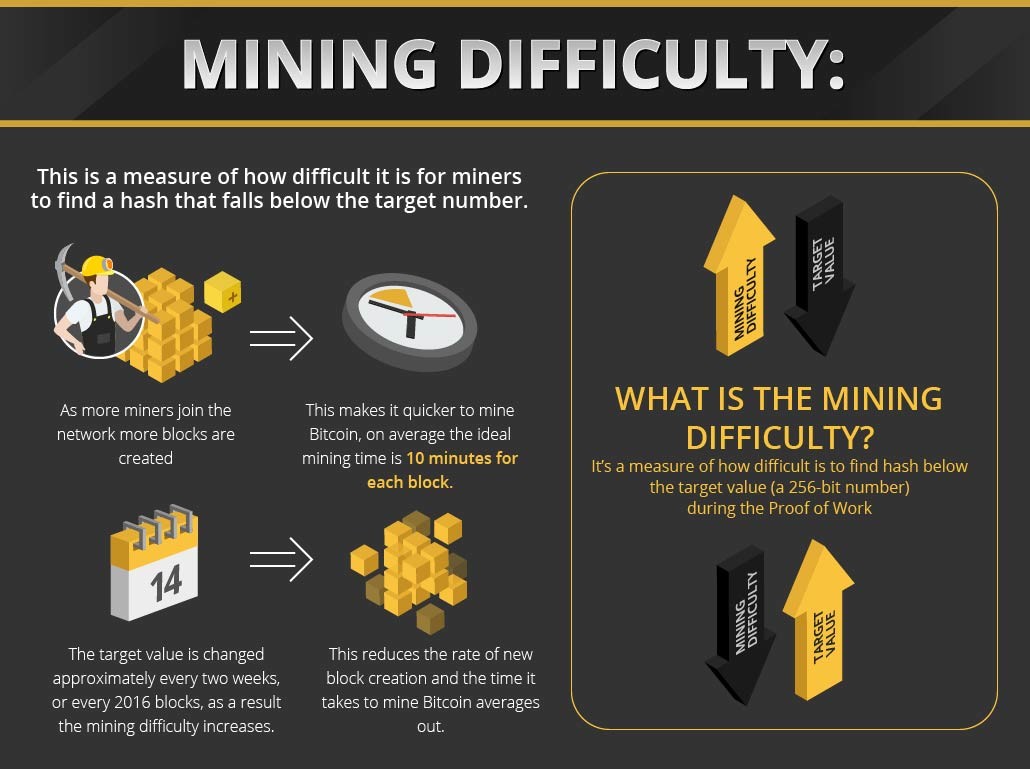

In the early times of bitcoin, mining was done with a simple home computer, but nowadays you need a powerful cloud of computers, a mining rig, to profit from it. Millions are competing with each other to obtain part of the mining rewards for each block, so, to make things fair, all the computers in the network reach a consensus: raise the mining difficulty to very high values.

While it can seem unfair for people with just an average computer, this is what makes bitcoin the strongest cryptocurrency: nobody can just try and hack random accounts and steal their bitcoins. That’s almost impossible, and, to do that, you need to invest far more money that you’ll be able to steal.

You can still mine bitcoins using just your computer, but that will not be profitable at all: you can join a mining pool and add your computing power to thousands of other people to earn a small portion of the rewards. You’ll get a tiny fraction of an already small fraction, but you’ll be contributing to secure the bitcoin blockchain.

Bitcoin value

What makes something desirable and valuable? Imagine a block of solid gold, or a case full of diamonds. Both objects are valuable due their scarcity, and desirable due to its durability and stability over long periods of time.

Bitcoin is something relatively new. Some people doesn’t even know about its existence, yet many people want to own some. That’s because, regardless of its age, bitcoin is already seen as a commodity —just like silver, gold or diamonds.

Of course, there are some ripples in our golden lake. Volatility, for starters. Bitcoin’s price isn’t stable yet, and it’s subject to speculation, fear, uncertainty about its future and veiled threats about bans and heavy regulations.

And that’s the part that seasoned speculators love most: fear can be profitable. FUD can be profitable.

Profiting from Bitcoin

Speculators are people that keeps only one universal truth in mind: buy low, sell high. They buy at bid prices and sell at ask prices. As bitcoin usually doesn’t fluctuate so much during a trading day, and it has a great volume, making a profit buying and selling bitcoin isn’t that hard to achieve. You only need to follow some guidelines:

Be refractory to gurus and experts spreading FUD:

FUD can be your best ally, but also your kryptonite. All the FUD spread by journalists and mass media must be taken cum grano salis, and always be used for your own benefit. If there’s a rumor about bitcoin being banned in some country, don’t panic: it’s almost always a ruse to lower the price so big actors can but larger volumes at a discount. Join (and enjoy) the party!

Never panic: bitcoin isn’t going to disappear or sink overnight. It can happen —and will happen eventually—, but it will not be today, tomorrow or the next month. You’ll see that coming.

Be prepared for long periods of sunken prices: a bearish market (i. e. a market that’s afraid enough that only a small fraction of people are brave enough to buy) isn’t rare, and you must be prepared for that. Always treat your investments in bitcoin (and any other crypto for that matter) like a hobby, and not like an actual income. You cannot predict when the markets will turn bearish or bullish; therefore, you cannot predict when you will be able to sell and obtain a profit. It can be weeks or even months until that happens. Again: don’t panic.

Repeat every morning: buy low, sell high: the only way to make a profit in volatile markets is repeating it like a mantra. There’s no way to teach you how to spot when a given commodity is low and when is high; we can talk about candlestick charts, OHLC charts, trends and SAR analysis, but it will be worthless if you haven’t a trained gut. Candlestick charts are invaluable, but they are just half of what you need to go out and succeed in a wild market like these.

In a nutshell

Bitcoin is a relatively new commodity, one that you cannot touch or hold in your hands, but you cannot just steal either. It’s stored on a blockchain, that is a virtual ledger stored out there, in the cloud. People can make a profit out of it in two ways: mining it (doing a hard, blue-collar job, with a fixed payment) or speculating with it (a white collar job if you ask, but with a fairly high risk involved, and high profits awaiting for those brave enough to give it a try).