A while back, we conducted 50,000 surveys of Information and Communication Technology (ICT) adoption and use by small to medium businesses and not for profits. We mapped 19 industry sectors and 480 business categories in depth, and then created workshops to help organisations understand which technologies would be useful and why.

The results provided a gateway for helping organisations better understand what ICT could do for them. How it could help improve communication, increase productivity, insight, information sharing and collaboration – all the things we now take for granted.

We surveyed which products and services were being used. We queried how these were “rated” by users, and what sources of help, information and advice on technology, respondents relied on.

Which was very interesting. Results were not necessarily those you might expect.

For instance, government sources of help, information and advice rated far lower than all other sources in every survey we conducted. By a huge margin.

And the digital revolution rolls on. Ever increasing connection, collaboration and integration of technology continue to change the landscape. Providing many opportunities beyond just the use of ICT in individual businesses.

And we now see that a relatively few large multinationals have grown to dominate and leverage this ever-connecting digital landscape in ways that many did not expect.

Opportunity for many has now morphed into threat for many. And Cambridge Analytica is just one example of what can happen when data is collected, aggregated and re-identified for vested interest. There are many others.

And it is unclear whether this can be reversed.

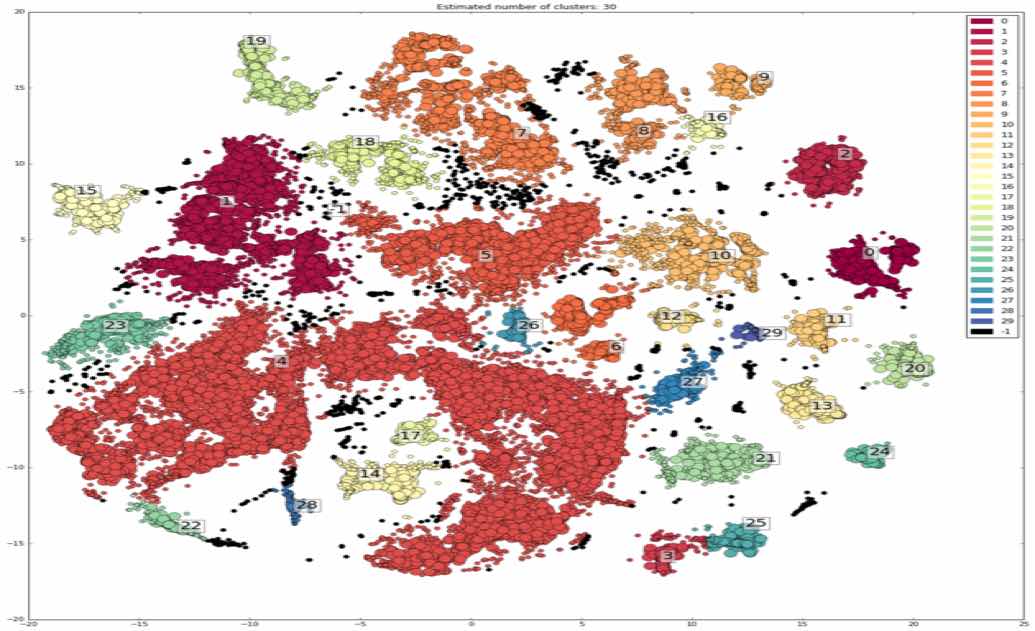

In reaction to this changing landscape, we reviewed our database and mapped for each industry sector and each business category, a picture of how twenty-three new technologies are now threatening Australian organisations.

Challenging jobs, businesses and even whole industry sectors and regions.

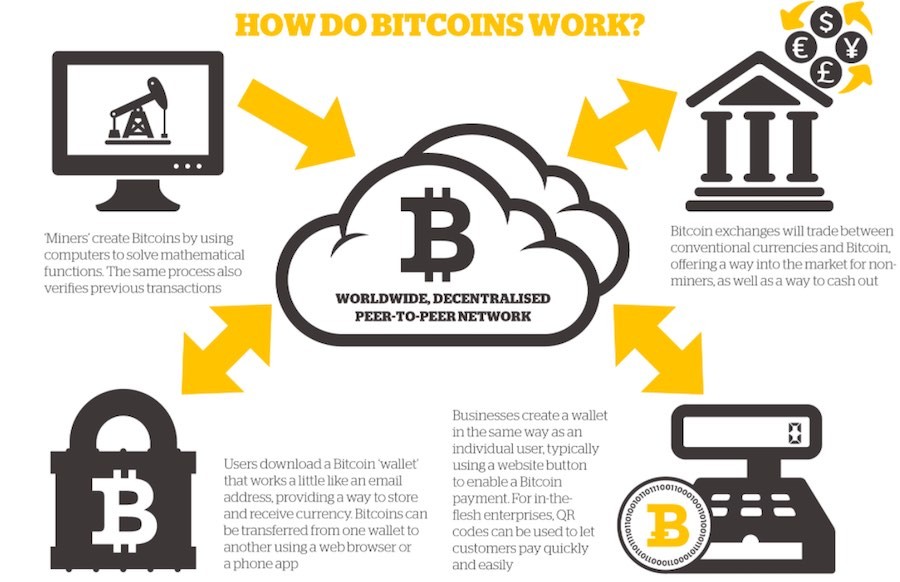

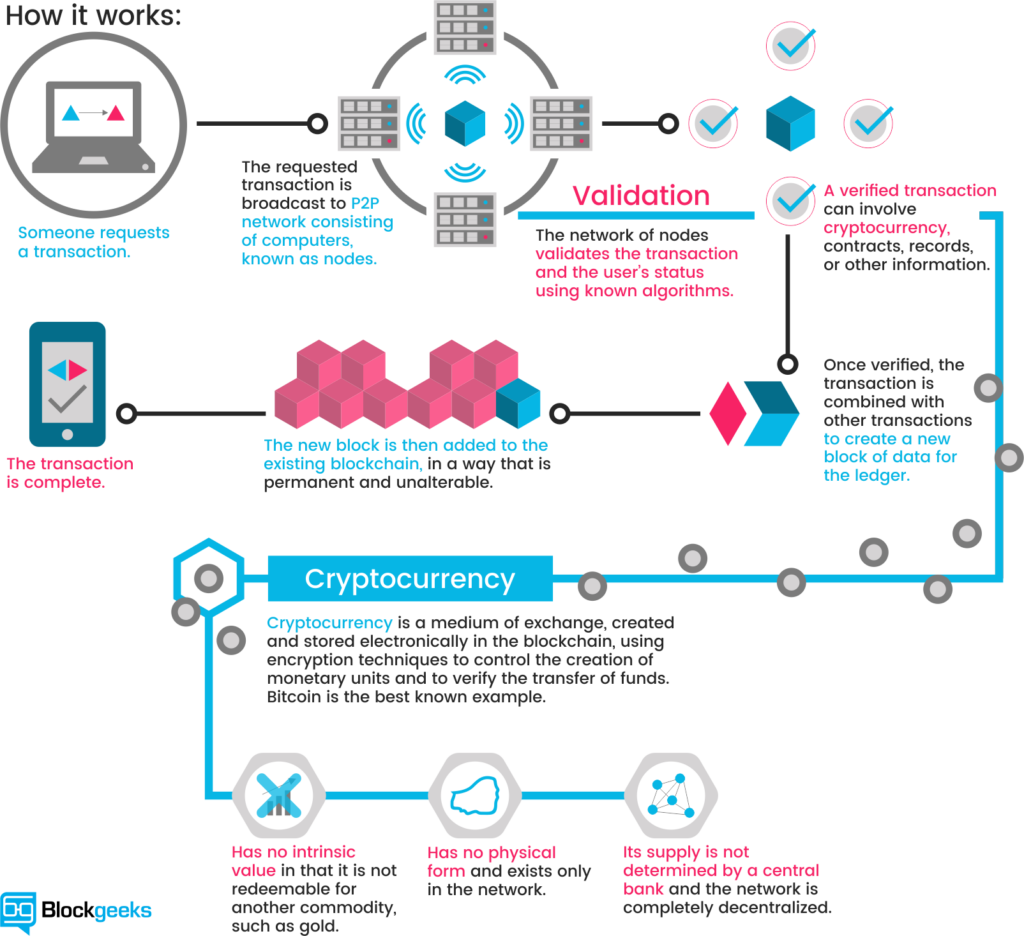

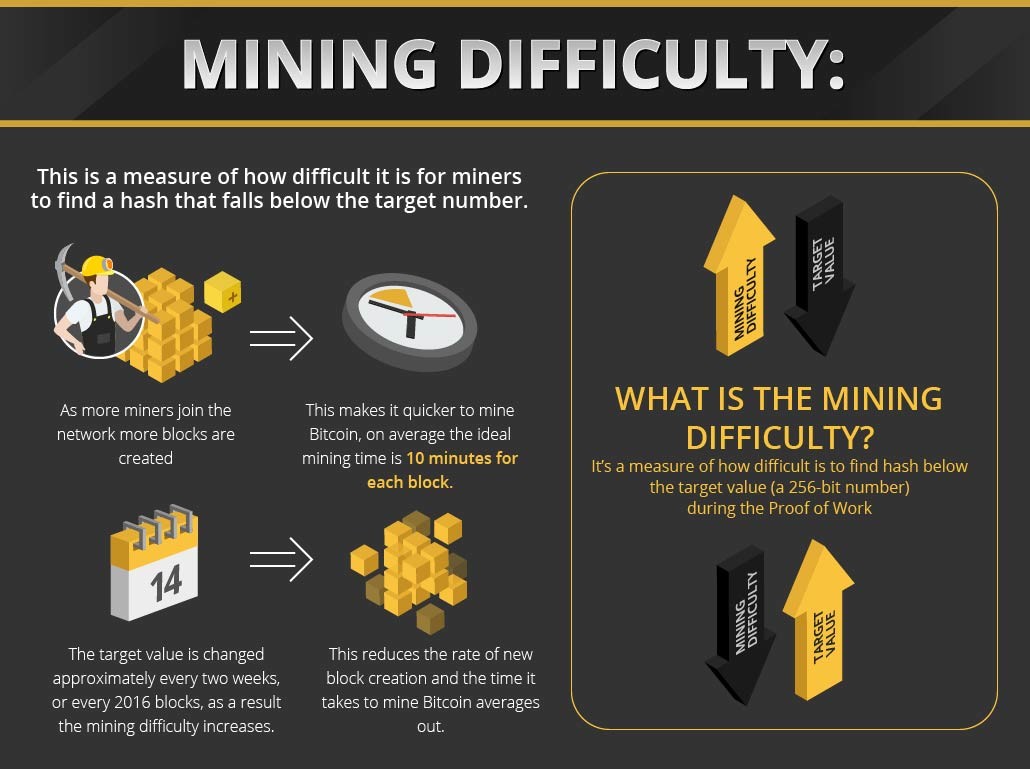

We looked at everything from Artificial Intelligence (AI), 3D printing, Augmented Reality, Internet of Things, Blockchain, Cloud services, BIM, GPS, 5G, Cryptocurrency, Cybersecurity, Drones, Digital Identity, IP protection, Mobility, Nanotechnology, Robots, Solar and Battery Storage, Virtual Reality, Amazon, airbnb, Freelancer, Google, Uber etc, not forgetting climate change and “fake news”, to define just how new technologies are collectively changing the work environment for better and for worse.

It is an interesting map and only makes real sense at the individual business category level, because businesses within an industry sector do many different things, and technology affects each business category differently, sometimes productively and sometimes negatively.

At the business category level, the impacts become personal. It is real people walking out the door replaced by technologies of all kinds. Software is implemented, efficiencies gained and restructuring does the rest. Roles are redefined and full time jobs are moved to contract, part time, freelance and even outsourced overseas.

We have all witnessed these changes. However, when you do the sums and add up the number of employees impacted by these changes over a relatively short time frame, the result is worrying.

We are told that as a result of digital disruption roughly half of existing jobs will be impacted in some way over the next twenty years. Not everybody agrees with the figures, but these predictions align with our research pretty well.

We can see, by matching each business category against all the potential impacts that roughly 6 million jobs in Australia are under threat, with 2.5 million over the next 5 years. Which is concerning when you realise than just over 12 million Australians currently have jobs and now half of those are under threat.

And according to Roy Morgan latest figures for May 2018, 1,196,000 Australians are now unemployed, and another 1,349,000 are now underemployed and looking for more work. Which is nearly 20% of the workforce.

And in most cases the job threat from digital disruption represents replacement not displacement. A robot or software product or both will replace the job completely, not just displace or push workers into some other job opportunity. Because the impacts are happening across every industry sector, and in every country pretty much at the same time.

The change suits some people, but not everybody has skill sets (brain skills, eye skills, hand skills, no skills) that can be easily translated and transferred to new job opportunities. Especially when there are even fewer new jobs available that AI, blockchain or robots can’t replace.

New jobs are being created, but these jobs are not for everybody and favour brain skills and eye skills = STEAM.

And you can’t move workers from one job activity into another job activity if workers are being pushed out of that area at the same time.

If we don’t prepare for this (and we are still only just talking about this, not actually doing anything), we are in for a big shock.

In this new digital version of workplace musical chairs, half the chairs are being removed simultaneously. Not just here, but across the world. With additional disruptive pressure coming from climate change, war, terrorism, refugee movement and political game playing of all kinds.

Currently, two of the biggest costs to Australian society (and treasurers) are health care and prisons.

People without jobs and meaning in society can (and do) become depressed, ill and a burden on health services (which are already stretched to the limit).

People without jobs and meaning in society can (and do) also become angry, hungry and desperate. And a significant number of frustrated individuals without jobs and no hope of finding a job, will react and respond in ways that lead to incarceration. Meaning more people in prisons.

Which we cannot afford, not just because of the dollar cost, but because of the impacts to families, children, communities and regions as well as the bottom line.

It all joins up.

At a time like this, cutting the tax rate for the richest in society is not a wise move. It will just confirm what most people already believe anyway. That our politicians have been highjacked by lobbyists, money and vested interests.

That the Australian “fair go” has disappeared.

“Fair gone”. And we let it go.

We need to support the makers in our country not the takers – support agriculture, creative industries, ICT, manufacturing, medical and health, mining services, smart trades and tourism. Give the tax cuts to productive industries – the “makers”, not banks – the “takers”.

But the digital revolution is far bigger than one budget. And will have a much bigger impact on what happens next.

But we are not completely helpless, regardless of government indecision. And it is not all bad news. If we respond in time then many of the negative impacts of digital disruption can be managed or slowed giving us time to think and act.

Ignore the digital threat or move too slowly, as we are doing at the moment, and the enemy will be at the gate before we are ready.

Governments prevaricate. It is their nature. The next election always takes precedent over action. Indeed the Murdoch press is in election mode already.

And few people can see the big picture. Those in the technology industry that do speak publicly with warnings about digital job destruction – Bill Gates, Elon Musk and Stephen Hawking among others – are not really understood. They can see it from the inside. We just see symptoms occasionally.

“Did you hear, Bill and Mary have been made redundant?”

And not all governments prevaricate. The Chinese government’s plan is to catch up with the USA on AI technology and applications by 2020 (just two years) and become a global AI innovation hub by 2030.

And the Chinese don’t just talk about these things. They do them.

Because they can.

While our governments at all levels, just talk, muddle and fuddle and worry about their seats in parliament or council. They don’t worry about our seats in the new game of workplace musical chairs.

We live in a comfortable country, surrounded by blue sea and sky, with the sun nearly always shining on this huge, well resourced island a long way from everywhere.

But we are not the only ones who make decisions about what happens here in a digitally, interconnected world. Decisions affecting us are made in China, the EU, USA, UK, Japan, India and Korea every day.

So we need to wake up to just how fast the world around us is changing.

And take action.

We need to do three things.

One. We all need to take time to really understand what is happening. Ask Google. Talk to a systems integrator. Then share, educate and inform others.

Currently, digital disruption is viewed a bit like climate change. The impacts are off somewhere in the future. Which is correct.

But that future is closer than you might think.

In the next three to five years we will see the first 1.5 million Australian jobs under threat, in financial services, retail, wholesale, rental and real estate, administration and support. As well as some categories in professional services and health.

And in the next ten to fifteen years, another 4.5 million jobs will be threatened as AI really takes hold.

Which for our children and grandchildren in Australian schools is going to be a challenge.

As a student, “what should I study in the short term and longer term?” And “how will the work environment I expect to enter change?”

Two simple questions. But highly relevant to students in schools, higher education and training. And to their parents.

These questions are also important to the rest of us. Because the technologies that affect students, will also affect our jobs and workplaces. With redundancies, contracts, offshoring, part time and no time.

So. Job one.

Understand what’s happening. Then help educate and inform.

We should all do that.

Job two.

Leverage the positive impacts and opportunities presented by digital technology, wherever we can. We have lots of allies in the systems integrators, web services and voice services across our nation. They deal with these disruptive issues every day.

But not everybody has the skills to be a systems integrator or work in the ICT industry. And the whole sector only employs a few hundred thousand people anyway.

We need to focus a lot more energy on a wider spectrum of Australian productive industries to diversify and spread risk in a country far too reliant on dirt, meat and wheat, and invest more of our money, brains and creativity into a broad suite of value-added products and services. Then offer them to the world.

We have to move beyond commodity “cargo cult” thinking. We are very fortunate to have a productive mining sector and a farming sector, but we need to broaden our vision for the future.

Job three.

Mitigate the risks and the threats (slow them down) where we can’t change them.

Example. News Ltd and Fairfax support and protect the real estate industry from threat, because they own Realestate.com and Domain.com, both of which rely on the real estate industry for providing and uploading content into their sites.

So it is in the interests of both publishers to “talk up” property investment and house prices, which they do, and also try to protect real estate agents from the impacts of alternatives, which they also did.

But this is rearguard action. It will only slow change down, not prevent it. And change will come, and is coming now from blockchain and AI. And real estate agents will ultimately be just a subject page in history books and Wikipedia.

But not quite yet.

Because change involves being “ready, willing and able”.

And technology requires adoption and use. There is a human element involved.

And choices.

So even though technology is now able to replace everything real estate agents do, News Ltd and Fairfax are not ready or willing to support the change. And real estate agents don’t want it either.

So vested interests can slow things down for a long time. Just think how much time the tobacco industry bought through political lobbying, strategic blocking action and denial – 60 years.

Threatened industries can be protected for a while. But only to offer time to migrate, translate, pivot and evolve into something else. Or be disintermediated.

Because the new threats are coming from everywhere and the investment in new technologies is enormous.

Each business category has its own story. And each category is at different stages of readiness, willingness and ability.

And each category has a different set of vested interests in play. And these factors can offer regions, sectors and business categories time to move to safe ground. We need to leverage this fact, with eyes wide open. Strategically.

Yes, jobs will disappear. Lots of them.

But by using a little wisdom and understanding, we can help organisations and individuals to migrate, train, learn new skills, avoid the categories under most threat and generally turn threat into opportunity whenever possible. It won’t always be easy and it won’t always be possible.

But we have to face up to the facts. Not ignore them.

For our part, on a more positive note, we have already created a showcase of Australia’s best of breed manufacturers and producers for the world to see. A shop window of what we do best – produce, manufacture and create.

https://theredtoolbox.org/index.php/showcase-fp

If you know of any additional manufacturer, producer or service that should be included, let us know. And we will add them.

We have also begun to directly “build bridges” between Australian businesses and businesses in other countries, starting with India, partnering with the Australia India Business Council so that Australian businesses and Indian businesses can talk and engage. To increase export.

https://theredtoolbox.org/index.php/groups-3

We will add other countries into that “bridge building” framework in due course.

And last, but not least, we are now working on a new project based on the 50,000 surveys I spoke about – the ED Toolbox, designed to help students and parents better consider and understand the impacts of twenty three disruptive technologies on 400 business categories across 19 industry sectors, to grasp how those business categories will be affected and when. And what that might mean to work and jobs.

Because students and parents need help in understanding that the world of tomorrow is not the world of today or yesterday. And tomorrow is coming quicker than expected and disrupting the world of work and jobs, not just here but everywhere.

So as we now begin to engage with teachers, schools, consultants, training organisations and others on this project, we are inviting help and input.

First stage: Ed Toolbox for Students and Parents

This is a relatively simple tool that allows a student and parents to consider the impact of twenty-three disruptive technologies on 400 business categories across 19 industry sectors.

The tool should help in considering and planning study and work options for the future.

Second Stage: Ed Toolbox for Schools

This will be an extended version of the ED Toolbox, incorporating a social platform to allow discussion between students, parents and teachers, plus offering the potential to connect to and engage with a range of businesses already responding to the impacts of digital change in their workplaces.

Real world case studies.

We will also include a much wider group of interested parties in the development discussion, and in the solution.

So we are meeting with schoolteachers and principals to get input and advice. Anybody with productive ideas on the project can sign up to the RED Toolbox for free and join the discussion.

Disruptive change is now a fact of life. But it is time to collaborate, push back and manage digital disruption to our advantage. Not just roll over and let it happen.

Ivan - join our BBG Innovation forum to collaborate, learn and grow - and explore solutions and plan for jobs for the future